The government’s move to put the brakes on housing investment may lead to house price drops of 10% or more – exactly what Jacinda Ardern said she didn’t want to happen. On this week’s episode of When the Facts Change, Bernard Hickey talks through the consequences of this week’s big announcements.

This week on When the Facts Change, Bernard is joined by Kiwibank chief economist Jarrod Kerr and Māori housing advocate Jade Kake to unpack what the new housing rules really mean. Subscribe on Apple Podcasts, Spotify or your favourite podcast provider.

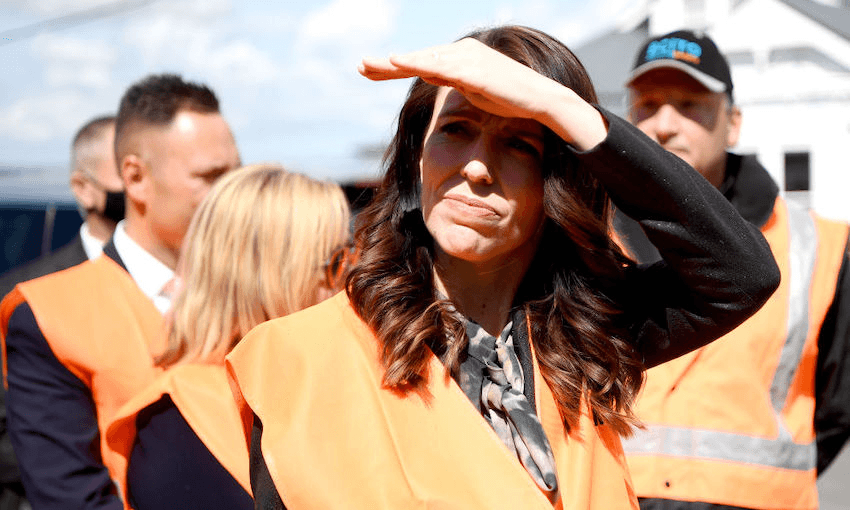

Prime minister Jacinda Ardern said in December and again this week she didn’t want the value of voters’ “main asset” to fall. She said voters’ “expected” moderate inflation of house prices of around 4% per annum, implying the government wouldn’t do anything to endanger that.

The Reserve Bank also acted dramatically early last year to rescue the housing market and use its wealth effect to bolster the economy in response to Covid-19, effectively declaring it a “too-big-to-fail” market and its main monetary policy lever. Understandably, investors thought housing was now a tax-free one-way bet.

But this week’s big tax deductibility move and the Reserve Bank’s moves towards limiting interest-only loans may drive prices down 10% or more. Will the government and Reserve Bank blink and jump back in to either soften the tax package or support the housing market again with lower interest rates and easier LVR rules?

I look at these questions in this week’s episode of When The Facts Change, my new podcast with The Spinoff and Kiwibank. I talk with Kiwibank chief economist Jarrod Kerr about the government’s housing package, including the surprise removal of interest deductibility, a $3.8b infrastructure grant fund and $2b of new loans for Kāinga Ora. We look at whether the Government can sustain the shock if house prices fall 10% as some predict, and whether the Reserve Bank might have to intervene again to prop up a housing market that appears to have become too big to fail.

I asked Jacinda Ardern if she would follow through, even if house prices fall and rents rise. The heat is now on the government’s most aggressive move in four years to try to tame the housing market beast.

I then talk with independent housing researcher Jade Kake about a lack of action on Māori housing, which got just one line in the budget and failed to address woefully low caps on loans for new housing on Māori land, along with arcane rules about building relocatable housing.